We could talk all day about the interesting challenges our clients bring us and the strategies and techniques we’ve used to solve them — but we’ll just leave these here for you to peruse.

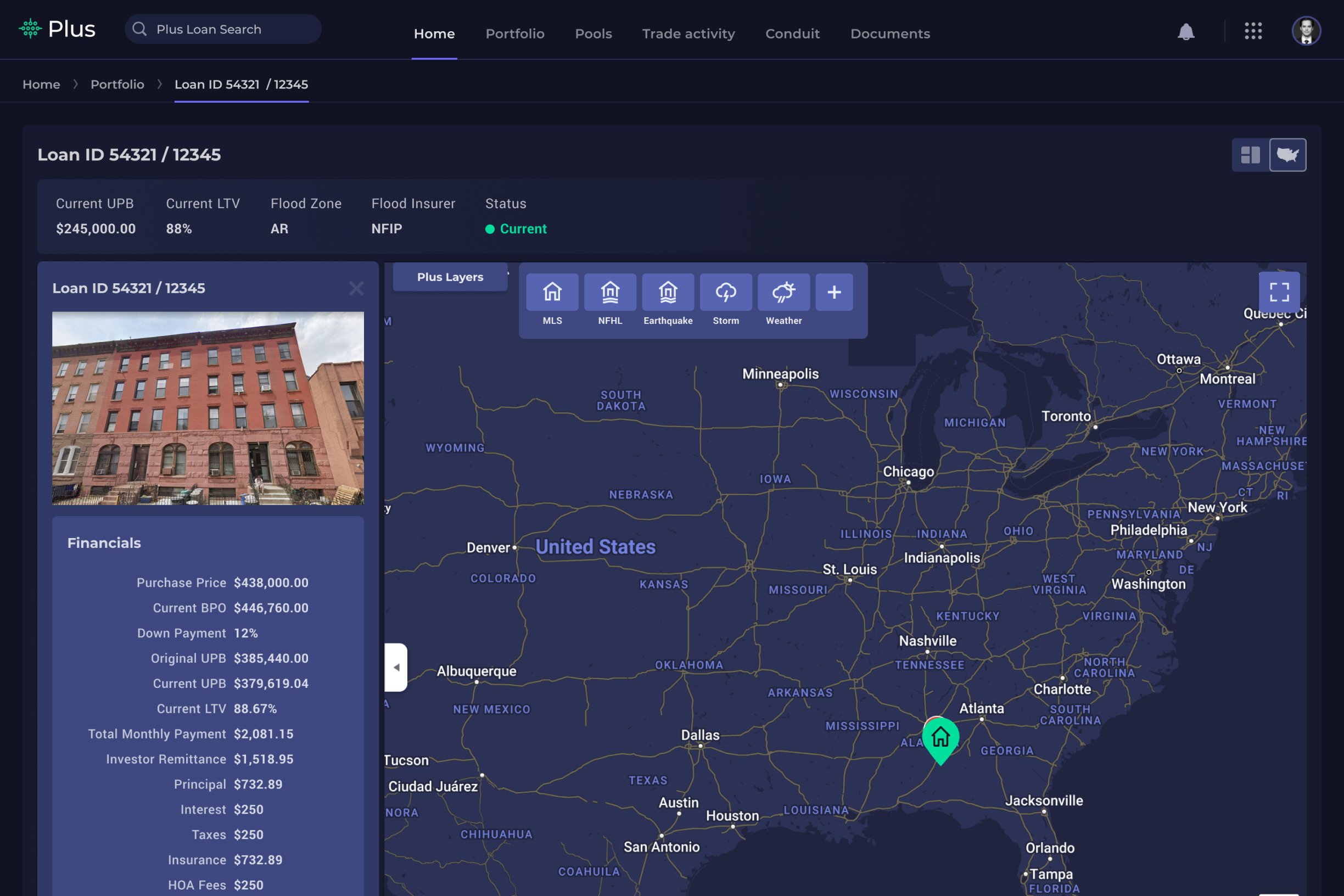

Plus

We joined forces with mortgage industry expert Buck Collins to found a new venture with the goal of creating a next-generation asset management and trading platform for the US mortgage market that allows users to enhance data, manage portfolios and transact with ease.

Find out more

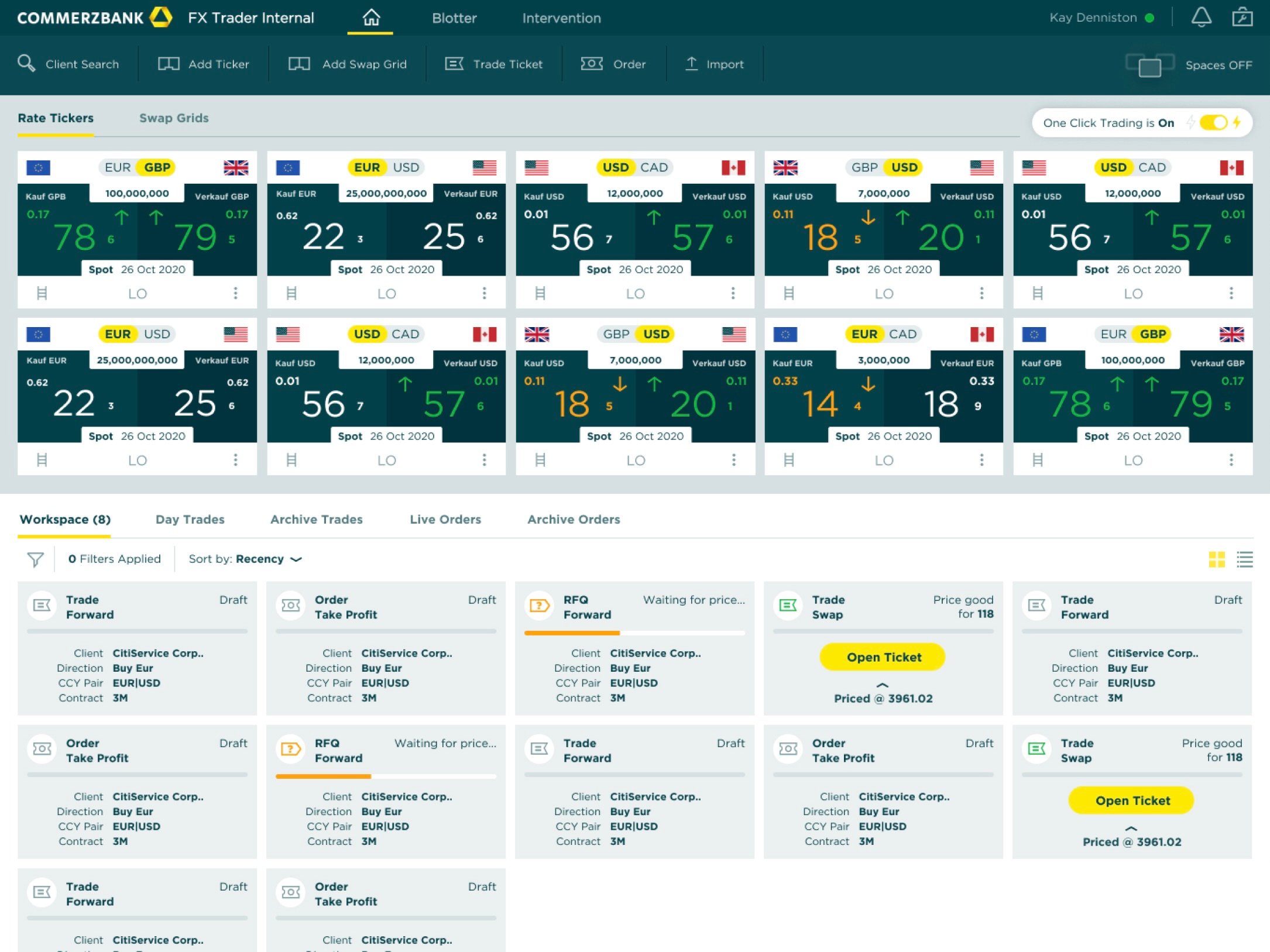

Commerzbank

Commerzbank is a leading global banking and financial services company, and a pioneer in electronic FX trading. We’ve been working together since 2013 across mobile and desktop applications as well as ad-hoc UX, design and build projects across the bank’s operations.

Find out more

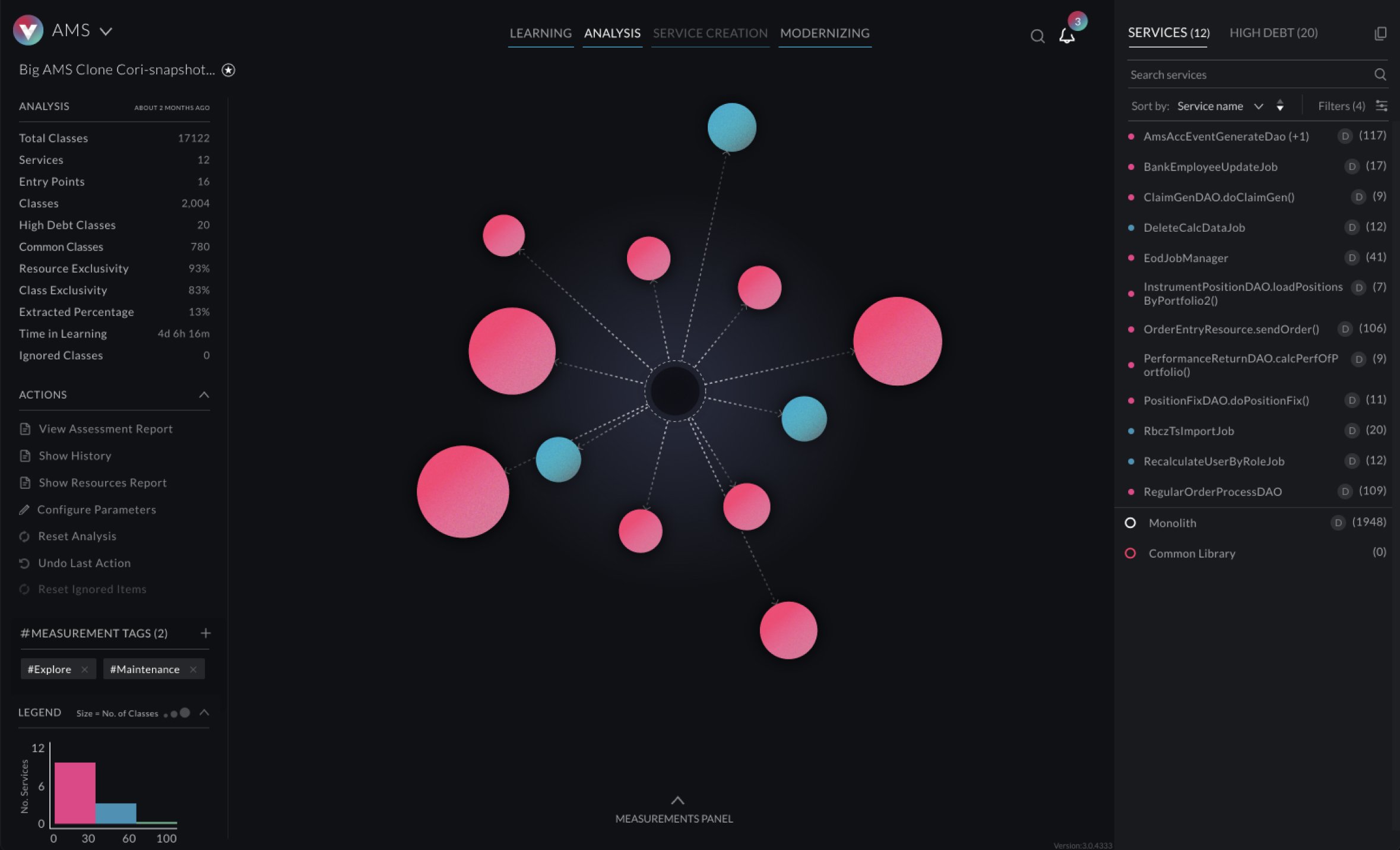

vFunction

vFunction are a start-up organisation based in the US and Tel Aviv that have created an innovative platform for businesses that need to modernise their Java applications and transform them into microservices.

Find out more

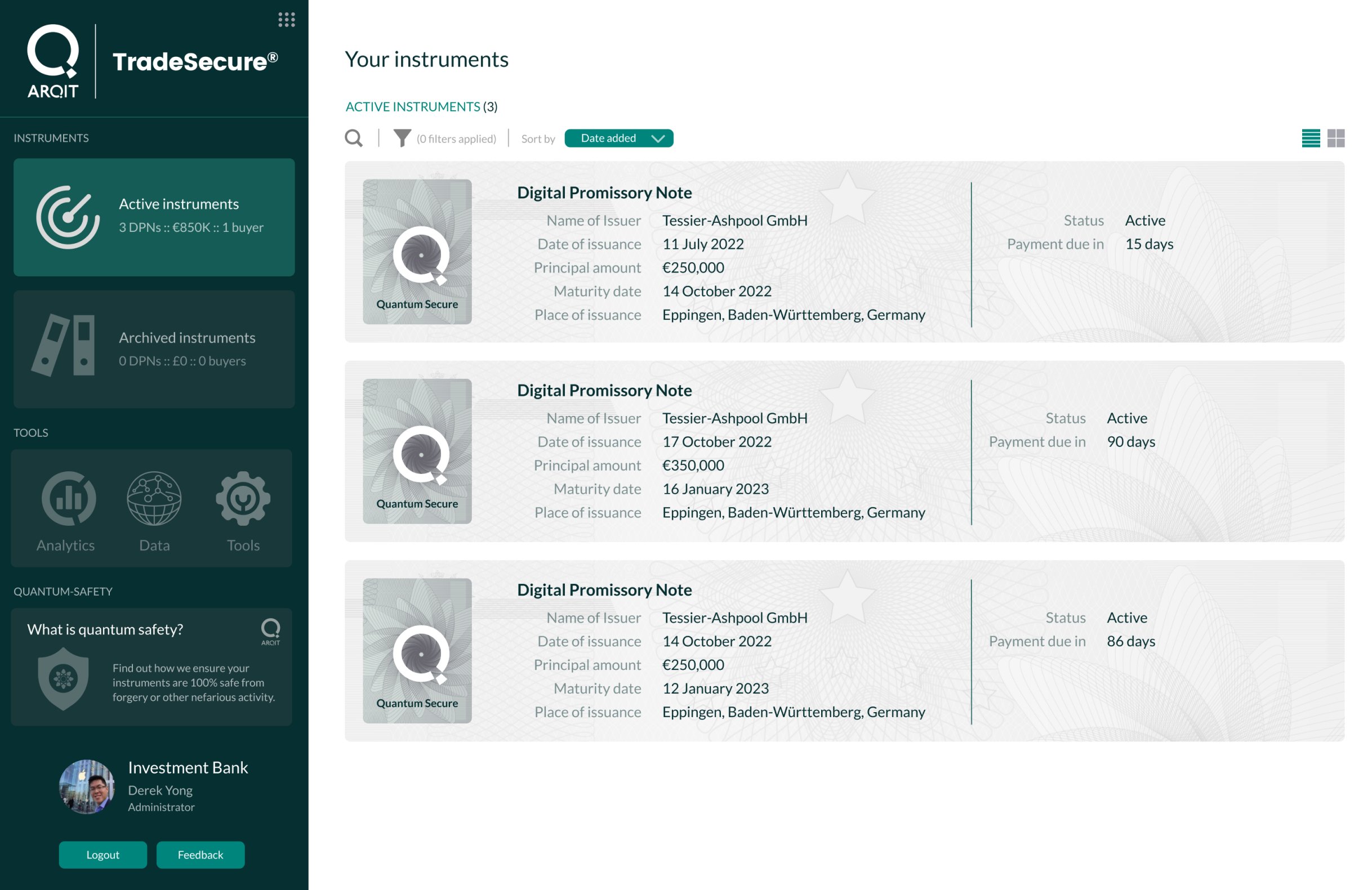

Arqit

Arqit is the UK company behind QuantumCloud™, a cloud-delivered symmetric key agreement PaaS. We collaborated to develop a platform for the quantum-safe minting and management of digitally-native financial instruments, helping to accelerate and optimise supply chain finance using distributed ledger technology.

Find out more

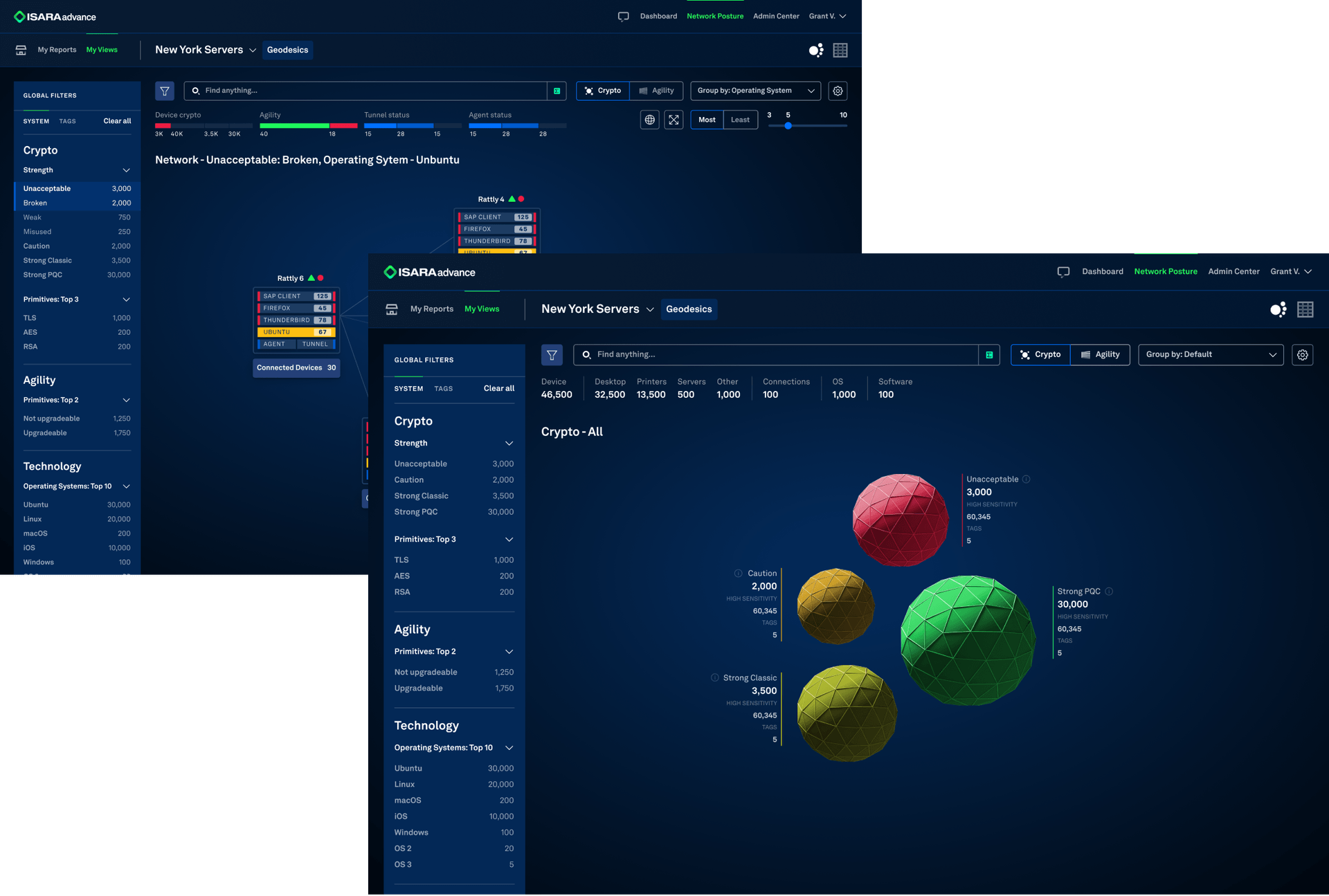

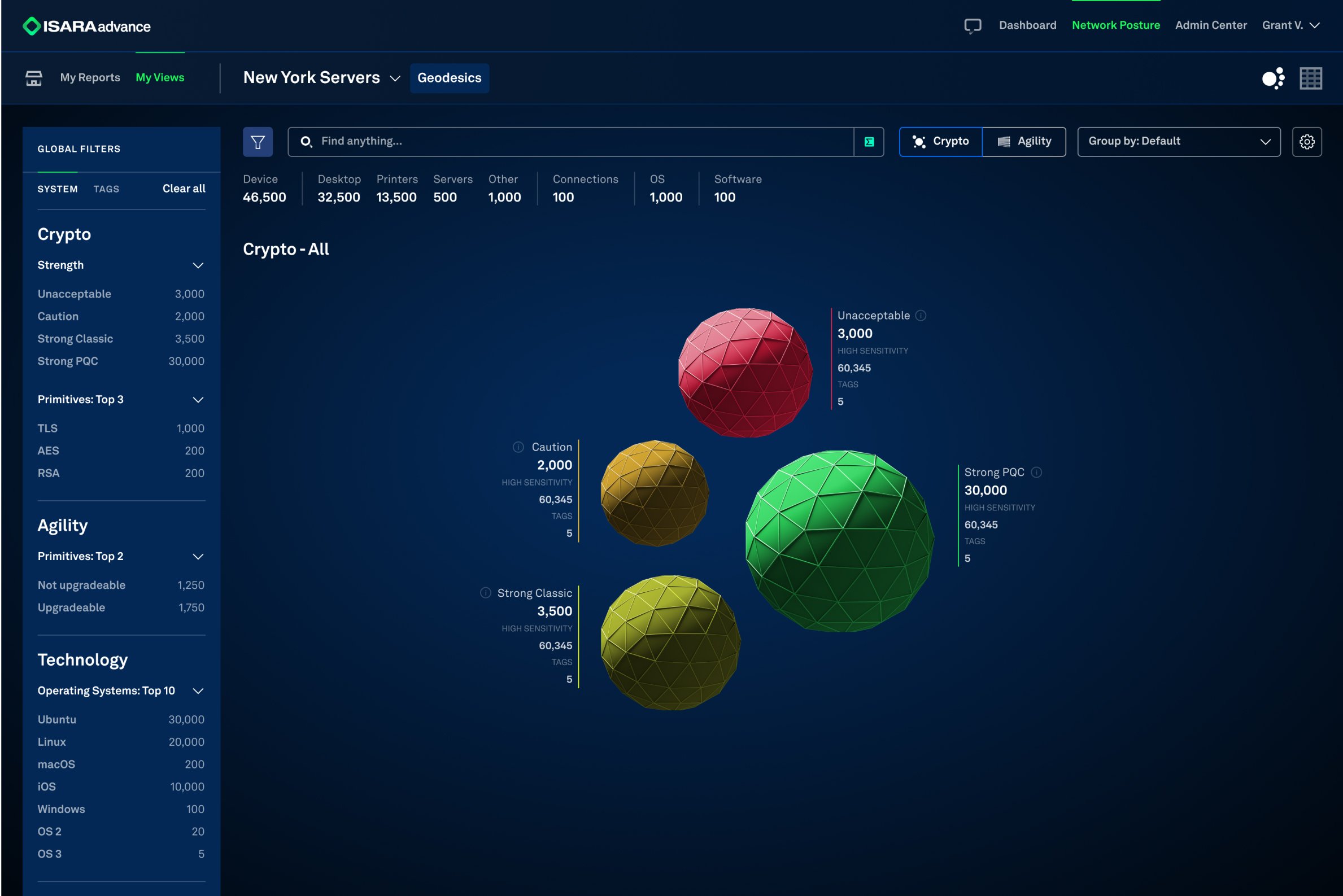

ISARA

Working with ISARA, a security solutions company, we rapidly developed a product which allowed users to easily access their cryptographic infrastructure from an intuitive and elegant dashboard.

Find out more

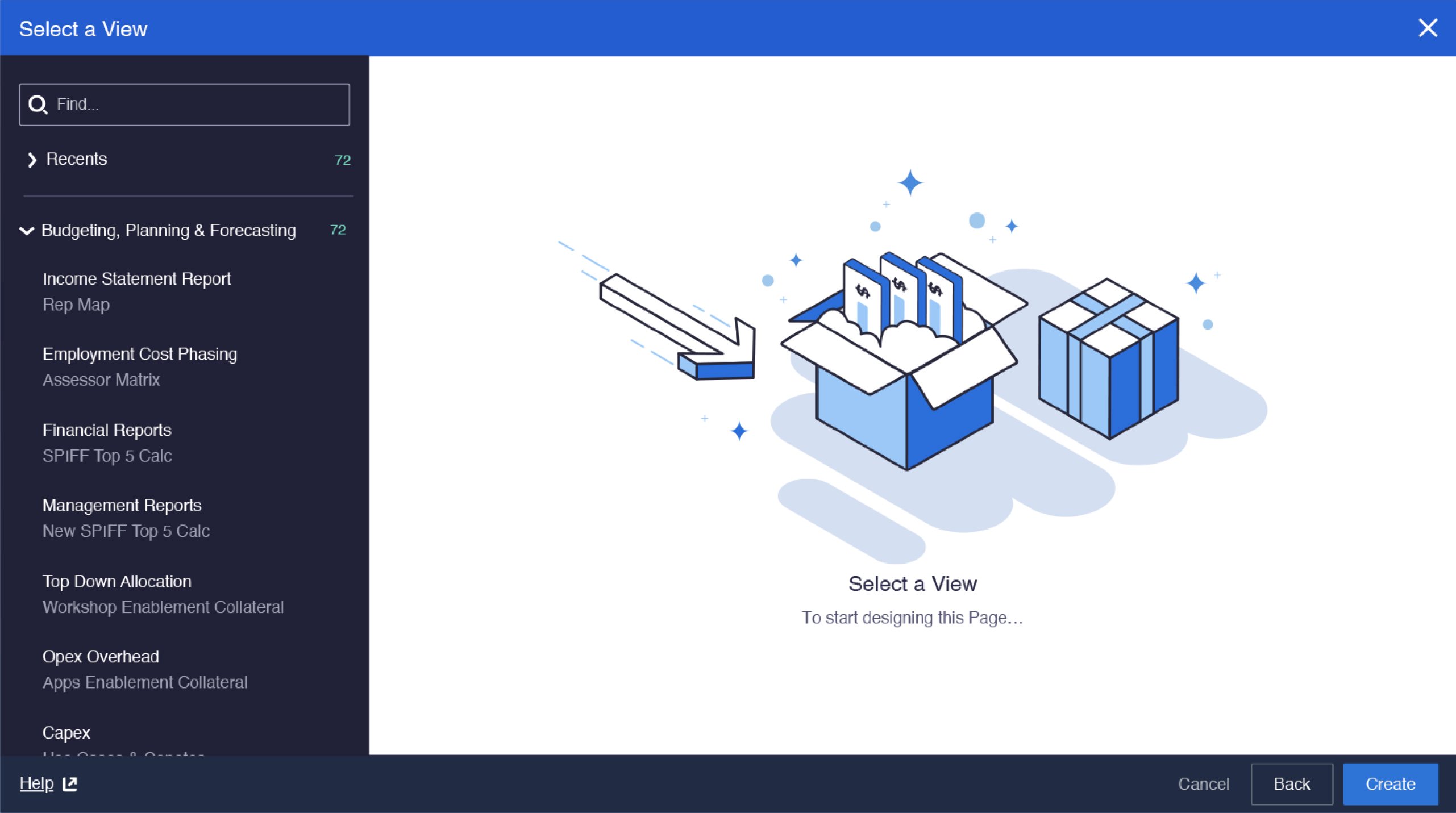

Anaplan

Integrate with global teams to produce the next level and version of the software platform in order to get to a IPO endpoint

Find out more

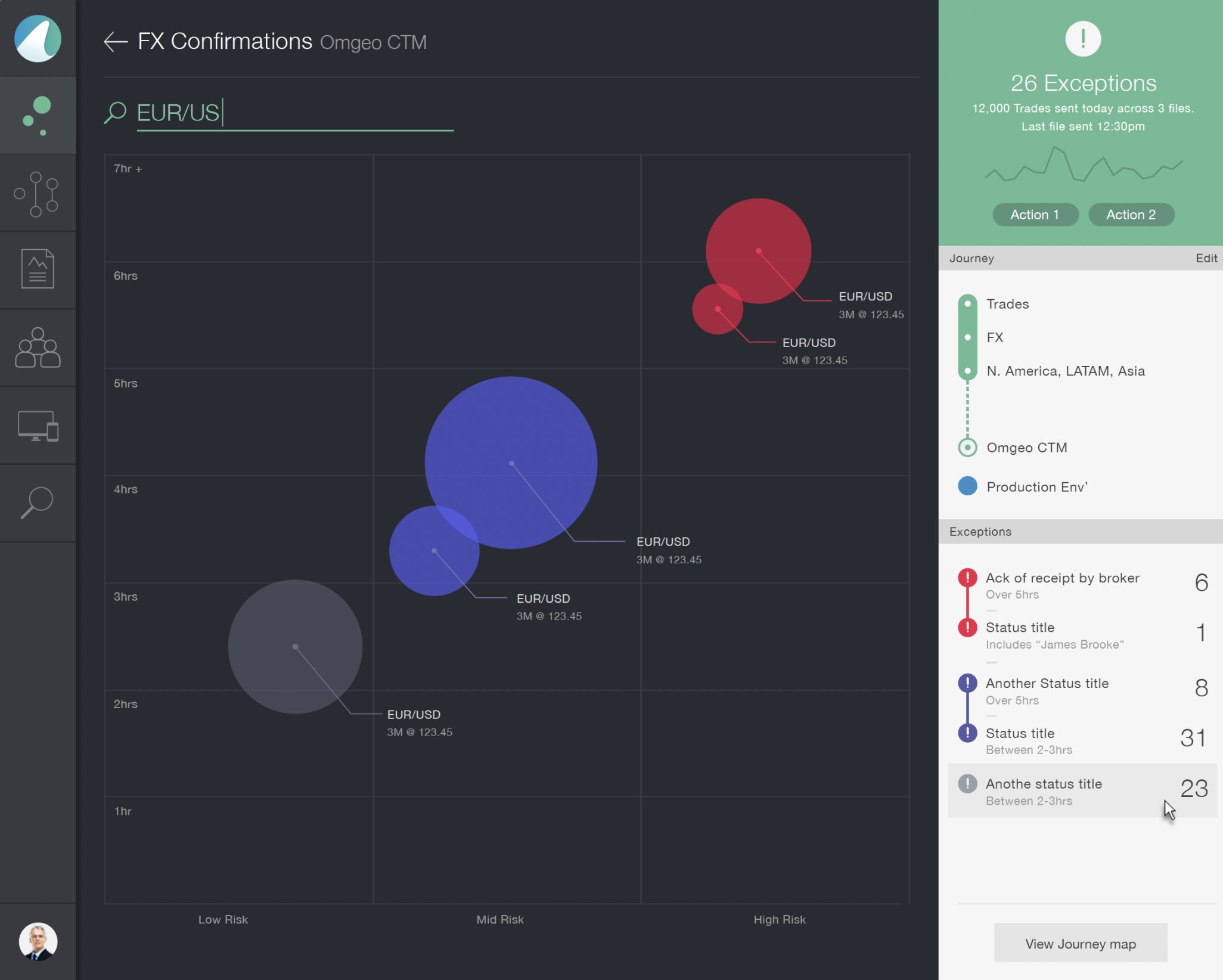

Access Fintech

A beautiful and highly innovative risk management service for both sell-side and buy-side. Access Fintech helps firms track the trade lifecycle and get a true sense of prioritised risk across today’s increasingly complex financial ecosystem.

Find out more

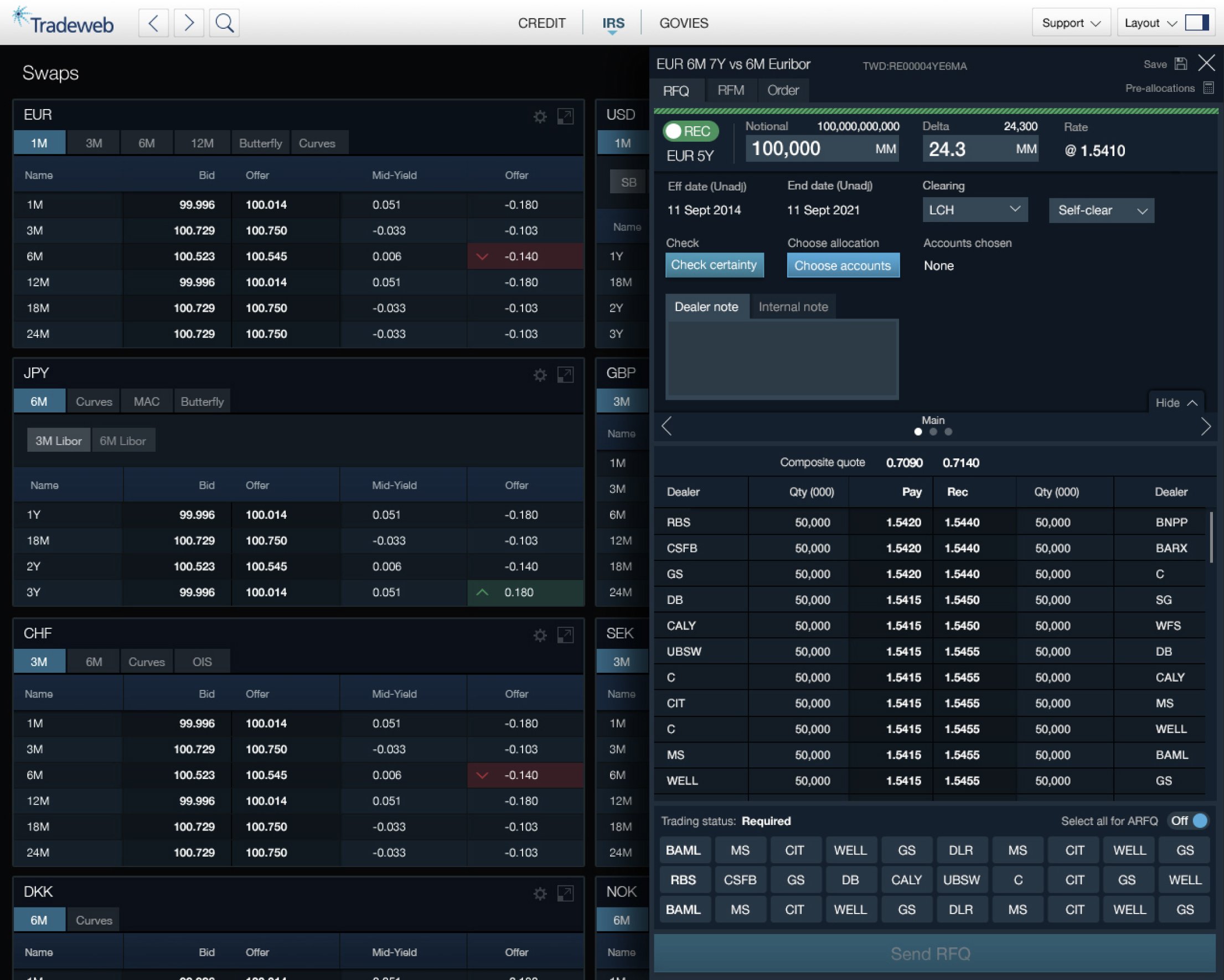

Tradeweb

A beautiful, useful and highly useable trading platform for corporate bonds, revitalising an old UI , modernising a tired identity, and pioneering an organisation-wide adoption of new web technologies.

Find out more

Bank Of England

We could talk all day about the interesting challenges our clients bring us and the strategies and techniques we’ve used to solve them — but we’ll just leave these here for you to peruse.

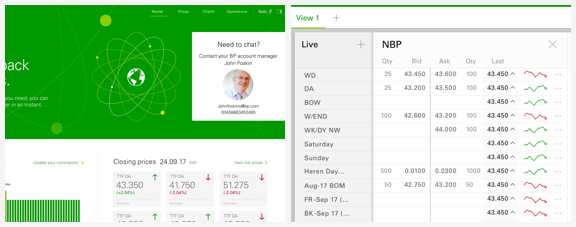

BP

Like Fathom, BP share a passion for re-imagination - in our case, software; in their case, energy. The Nucleus energy trading platform lies in the centre of the Venn diagram of those two overlapping interests. Our skill and experience from designing and building financial trading systems was invaluable in making Nucleus an example of beautiful, useful simplicity.

Market Axess

MarketAxess is a global leader in fixed income electronic trading, and our multi-year partnership with them has spanned multiple global business lines. The first was to prove our HTML5 build capability; in the projects that followed we have worked to simplify their interaction patterns and modernised their visual identity. Our work has laid the foundation for a robust design system, providing a vision for the company when it came to their platform. We continue to work together on internal build support, design standards and systems.

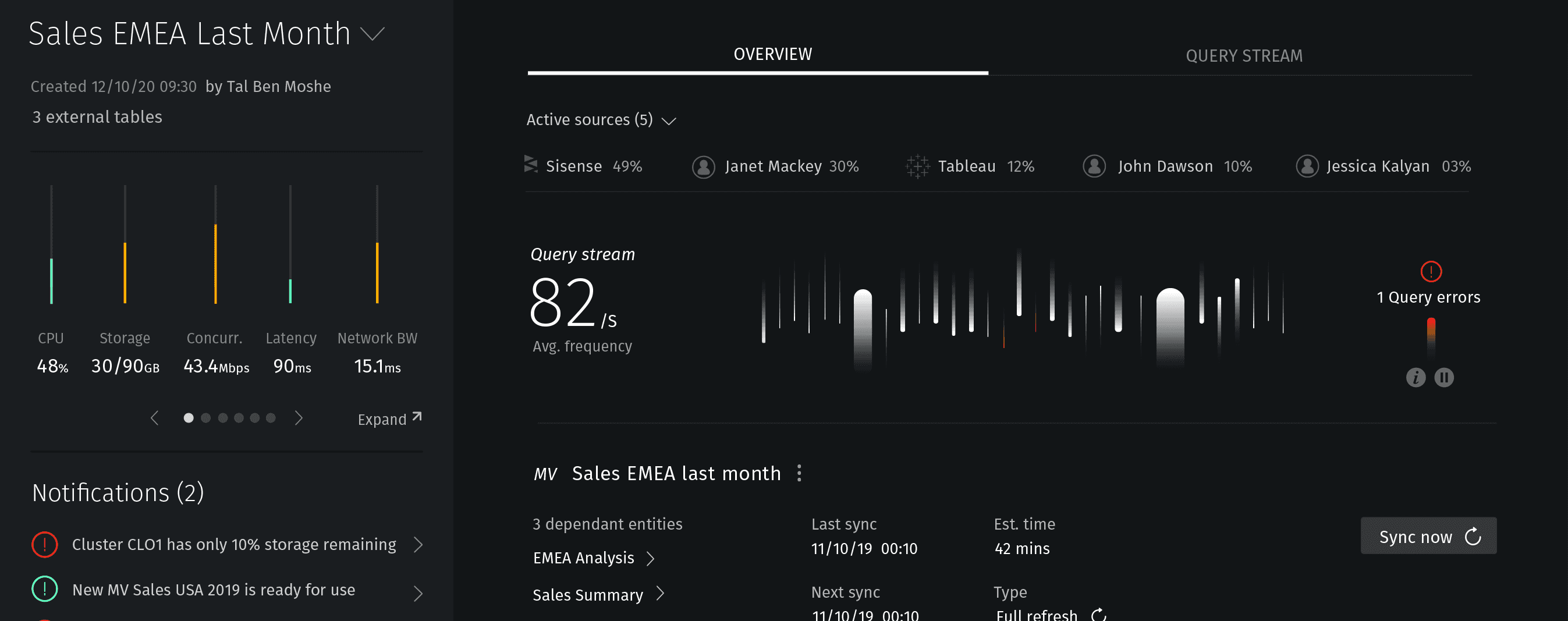

Varada

The Power of Inline Indexing™ is at the heart of Varada’s innovative approach to enable interactive analytics on large and complex datasets. Inline Indexing reflects data as a mesh of nanoblocks™, each independently indexed and inter-connected. Any SQL query on Varada will fly across nanoblocks™ to filter, join and aggregate using indexes across a variety of domains.

SGX

In 2017, Fathom was invited by the Singapore Exchange - Asia's most international, multi-asset exchange, operating securities, fixed income and derivatives markets - to help them with their first foray into electronic trading of commodities derivatives.

EBS

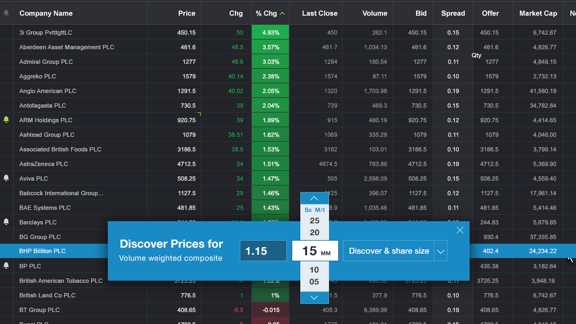

The electronic trading division of NEX Group (formally ICAP) includes units dedicated to different asset classes, including FX. The unit famed across the industry as EBS BrokerTec (now known as NEX Markets) offer a suite of FX trading applications, including EBS Market.

Cappitech

Cappitech is a privately held Financial Technology Boutique offering bespoke trading and reporting solutions to both buy side, sell side and major service providers.

Goldman Sachs

The Goldman Sachs Group, Inc. is an American multinational investment banking firm that engages globally across investment management, securities and other financial services, primarily with leading institutions and corporations.

ITG (now Virtu)

What do you do when you want to know where electronic trading might be in 5 years time? When you want to understand how current technology trends will impact your market offering? When you want a compelling, market-beating vision of future trading software? You call Fathom.

Linedata

Linedata capital market offerings across software, data & analytics and services. In late 2016 they were actively planning to evolve their existing technology stack - and asked Fathom for some help with creating a single, modern user experience for their customers across their entire and disparate suite of products.

Fathom Supergrid

With an extensive built-in tool set and fully integrated search support, as well as RFQ ticketing flows and contextual market depth information panel, stunning data visualisation capacity and a responsive multi-channel design.